7 Ways to Pay Less Taxes in 2024

Quick Take

Important tax changes started on January 1st, and many of these changes affect all taxpayers. It is important to review these changes as they pertain to your situation.

The Consolidated Appropriations Act, also known as SECURE Act 2.0, scheduled new changes starting in 2024 that affect 529 accounts, qualified charitable distributions, and more.

Just as the new year provides new opportunities, new tax years provide the same. Here is a list of important changes coming in 2024. These figures are important in considering smart tax planning for the year ahead.

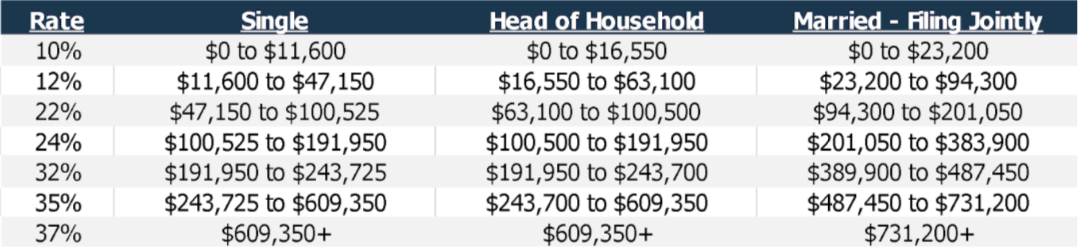

Inflation Adjustments for Tax Brackets and the Standard Deduction

Let’s start with a change that affects all taxpayers. Tax brackets and the standard deduction are subject to annual inflation adjustments. Year-over-year inflation peaked in March of 2023, but consumer price inflation (CPI) still increased at a muted pace through the second half of the year. This increase prompted big changes to tax brackets.

This means the same gross income generates a smaller tax liability compared to 2023. Of course, this adjustment comes at the cost of the inflation experienced throughout 2023.

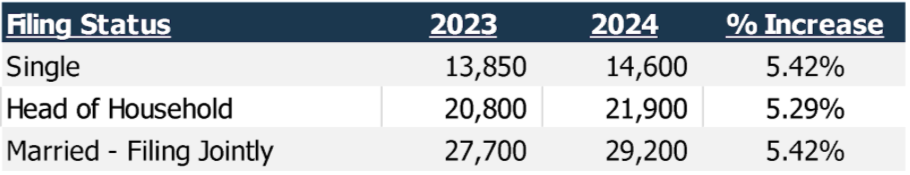

The standard deduction received another large bump in 2024. The 2023 tax year included one of the largest year-over-year inflation adjustments in the history of the standard deduction, and the 2024 tax year provides another large adjustment.

2. Contribution Limits to Retirement Accounts

Both employer-sponsored plans and individual retirement accounts (IRAs) have annual contribution limits. In 2024, these accounts receive an inflation adjustment. Traditional and Roth IRAs now allow a $7,000 annual contribution limit, up from $6,500 last year. Workers can also contribute up to $23,000 to their employer-sponsored 401(k), 403(b), and 457 plans.

While there was no adjustment for catch-up contributions for workers age 50 and older this year, we know these limits are receiving major changes in 2025 as a result of SECURE Act 2.0 passed in 2022.

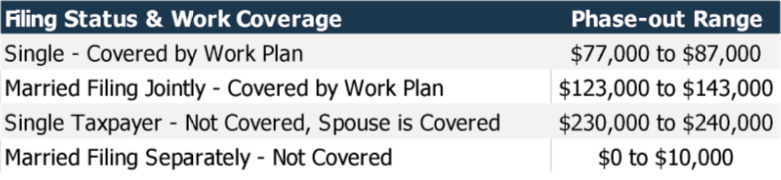

3. IRA Deduction & Roth Contribution Income Phaseouts

Savers can receive a tax deduction for contributing to a traditional IRA. However, not everyone can receive this deduction based on their income and their eligibility to participate in an employer-sponsored retirement plan. The limits for the income phase-outs adjust for inflation.

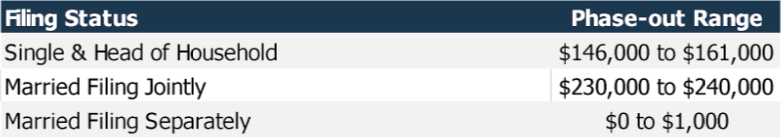

Like traditional IRAs, Roth IRAs have income phaseouts and limits. However, these restrictions are tied to annual contribution limits rather than a deduction. Savers over a certain income level are not allowed to contribute to a Roth IRA at all. These income limits adjust for inflation as well.

4. Qualified Charitable Distribution (QCD) Amounts

The charitably inclined may opt to gift directly from their IRA to qualified charitable organizations. The annual limit for QCDs has not changed since being introduced in 2006. SECURE Act 2.0 finally set a path forward for QCD limits allowing the limit to adjust for inflation annually. Those gifting from their IRA can now give $105,000 annually, up from $100,000 in previous years.

This also applies to a new QCD gifting strategy enabled by SECURE 2.0, funding the Charitable Remainder Trust (CRT) and Charitable Gift Annuity. The QCD limit increased to $53,000, up from the original $50,000 limit.

5. Annual Gift Tax Exclusion & Lifetime Gift Exemption

The annual gift tax exclusion, or the amount of money one can gift to an individual before needing to file a gift tax return, increases by $1,000 to a total of $18,000 per year. This amount is doubled for married couples meaning they can gift up to $36,000 to individuals annually.

The lifetime gift tax exemption is also adjusted for inflation and reaches $13.61 million per person in their lifetime. This means that a married couple can transfer up to $27.22 million in their lifetime tax-free. This limit sits at an all-time high. A provision in the Tax Cuts & Jobs Act of 2017 that nearly doubled this exemption is set to expire in 2026, but gifts made prior to 12/31/2025 will remain subject to the current rules regardless of any extension or expiration of this tax provision.

6. 529 to Roth Transfers Begin

Another provision from SECURE 2.0 takes effect in 2024, and it’s likely the biggest change the 529 account has seen since its creation. Overfunding a 529 account can be risky and costly. Prior to 2024, funds in a 529 account were subject to taxation and a penalty upon withdrawal unless used for qualified education expenses. Now, account holders have the option to transfer funds from the 529 to a Roth IRA in their name. These transfers are subject to annual IRA contribution limits, and the owner must have earned income in the year of the transfer. The lifetime limit for this kind of transfer is $35,000.

7. AMT Exemptions Increase

The alternative minimum tax (AMT) exemption increased from $81,300 in 2023 to $85,700 in 2024. The income phaseout for this exclusion also rose from $578,150 in 2023 to $609,300 in 2024. The AMT exclusion is also based on your filing status, meaning that married couples filing jointly have twice the exemption and income limit at $133,300 and $1,218,700 respectively.

While these are some of the highlights for 2024, there are more tax changes that may apply to your situation. It is important to consult with your tax professional to ensure that you are maximizing your tax benefits.

Contact us at 865-584-1850 or info@proffittgoodson.com

DISCLOSURES: The information provided in this letter is for general informational purposes only and should not be considered an individualized recommendation of any particular security, strategy, or investment product, and should not be construed as investment, legal, or tax advice. Proffitt & Goodson, Inc. makes no warranties with regard to the information or results obtained by third parties and its use and disclaims any liability arising out of, or reliance on the information. The information is subject to change and, although based on information that Proffitt & Goodson, Inc. considers reliable, it is not guaranteed as to accuracy or completeness. Source information is obtained from independent financial data suppliers (Interactive Data Corporation, Morningstar, etc.). The Market Categories illustrated in this Financial Market Summary are indexes of specific equity, fixed income, or other categories. An index reflects the underlying securities in a particular selection of securities picked due to a particular type of investment. These indexes account for the reinvestment of dividends and other income but do not account for any transaction, custody, tax, or management fees encountered in real life. To that extent, these index numbers are artificial and cannot be duplicated in real life due to the necessity of paying those transaction, custody, tax, and management fees. Industry and specific sector returns (technology, utilities, etc.) do not account for the reinvestment of dividends or other income. Future events will cause these historical rates of return to be different in the future with the potential for loss as well as profit. Specific indexes may change their definition of particular security types included over time. These indexes reflect investments for a limited period of time and do not reflect performance in different economic or market cycles and are not intended to reflect the actual outcomes of any client of Proffitt & Goodson, Inc. Past performance does not guarantee future results.

financial advisor Tennessee, financial planner Tennessee, wealth manager Tennessee, financial coach Tennessee, retirement planning Tennessee, fiduciary financial advisor Tennessee, wealth planner Tennessee, wealth planning Tennessee, wealth strategist Tennessee, wealth coordinator Tennessee, investment planner Tennessee, CFP Tennessee, financial expert in Tennessee, money manager in Tennessee, boutique wealth management in Tennessee, boutique money manager in Tennessee