A Wild Trip

A year ago, what had been a localized virus in a distant place spread across the world. Prior viral outbreaks – SARS, Ebola, Zika - never spread as feared. However, this one ended up being different. The world has certainly changed in the last twelve months, and the financial markets have shown they remain resilient to new challenges.

We were all forced to figure it out on the fly. Governments and businesses scrambled to address the worst viral outbreak in nearly 100 years. Without clear guidance, we debated what exactly constitutes risky behavior in a pandemic. Without knowing who would get really sick once infected, we stayed at home, shut segments of the economy, and hoarded toilet paper.

Humanity has shown resilience. It has not been easy, but with the help of modern medicine, there is light at the end of the tunnel. The economy has proven resilient too. Technology now allows most of us to order groceries, takeout, or other essentials from our smartphones. As daily office life was uprooted, many discovered new ways of working or even relocated out of major cities. With newfound schedules and less time commuting, over 4.4 million new businesses were created in this strange, new economy.

The trip the financial markets took echoed the emotional ride through this pandemic, losing 30% in near-record time. March 23, 2020, marked the bottom of the COVID-driven selloff. Helped by extraordinary government support, central bank action, and rapid vaccine development, global stocks recovered lost ground and are now up 78% in just over a year.

The stock market rally has continued into this year. The stocks leading the market have changed – large technology companies have taken a back seat to shares of companies most negatively impacted by the pandemic. This is an optimistic sign that investors expect broad economic growth as the economy reopens. Global stocks have gained 4.6% in the first quarter, led by shares in small domestic companies.

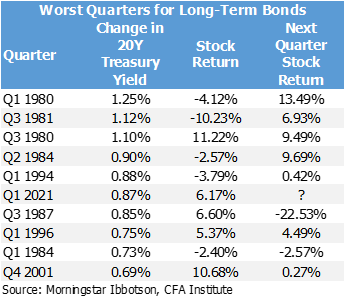

While stocks continued the good times, bonds have struggled year-to-date. The prospect of greater government spending and rising inflation sent bond yields higher. The yield on the 10-year Treasury bond rose 0.82%, one of the worst quarters for Treasury bonds since 1980. The Bloomberg Barclays Treasury Index fell over 4%. The broader US Bond Aggregate Index fared marginally better, declining 3.4%.

There is concern that a shock of higher interest rates might spook the stock market. Exactly how stocks should perform when long-term interest rates rise is not clear. Interest rates may rise when either the outlook for economic growth is improving or inflation expectations are rising. On one hand, higher interest rates can lower stock prices through what is known as the discount effect. At the same time, when growth is the driver of higher rates, corporate earnings tend to rise, helping to offset the negative impact of higher discount rates.

Interest rates also rise when inflation expectations rise. What matters for stocks is the extent that companies can push higher input costs through to customers, which boils down to pricing power. Some companies have it, others not so much.

Historically, stocks have been resilient in the face of higher interest rates, suggesting that companies have grown earnings even when inflation is rising. While any number of unexpected shocks could spur a downturn, higher interest rates have rarely been the sole driver.

WORRIES: THEN AND NOW

While much progress has been made against COVID, worries now are focused on potential ill-effects of public sector moves to support the economy. The list of speculations why the market could take a turn lower is long: higher taxes, higher government spending, new variants and a fourth COVID wave, yields that are too low, yields that are too high, or the market is just too high. History suggests the things we worry about are rarely the things we should be worried about.

The potential ill-effects of trillions more government debt could manifest in different ways, none of which are easy to predict. One result would be a fall in the value of the US Dollar due to a loss of confidence by foreign investors. Another possibility is higher inflation as a result of greater spending and demand-driven growth.

Yet, a globally diversified portfolio is well-positioned to deal with such risks. International assets, denominated in other currencies, can help protect against declines in the dollar. Large US multinational companies derive much revenue from outside the US, further insulating against US dollar stress.

As noted above, stocks can weather rising inflation if companies can pass on higher costs. In the bond bear market in the early 80s, stocks fared reasonably well. If the problems were to enter extreme, low-probability territory, large multinational companies could re-domicile to friendlier places. Because large companies can always “take a hike,” some have argued they are safer assets than government-guaranteed securities. While we don’t think any of these scenarios are likely, a well-diversified global stock portfolio may be one of the best solutions available to manage these risks.

WHAT IT ALL MEANS

Whether stocks are high or low, there is always uneasiness about what is lurking around the corner. It is ingrained in our biology. The world is unknowable, and we all are inherently vulnerable to the world around us. That lesson has been painfully present this past year. Dealing with money is no different. Growing wealth and planning for the future requires a leap into uncertainty. Only in hindsight do the choices seem easy.

No single strategy can guarantee success. No plan offers perfect insight into the future. This pandemic has shown that adaptability is important for resilience. Successful investing often amounts to a strategy that is grounded in strong principles but is also flexible enough to adapt to the changing environment. Tomorrow’s challenges will be different than today’s. Even though they are unknown, we still have the tools to learn, adapt, and survive.

Contact us at 865-584-1850 or info@proffittgoodson.com

Please see disclosures