April Showers

WHAT’S MOVING THE MARKET

COVID-19 (continued): Q1 GDP -4.8% – growth fears and supply glut tank oil market – Remdesivir receives emergency FDA authorization – will changes in consumer behavior persist?

Federal Reserve intervenes: junk bond ETFs receive support for first time – expansion of money supply – technical change to support bank lending

US government intervenes: initiates Payment Protection Program – sends stimulus checks

APRIL SHOWERS

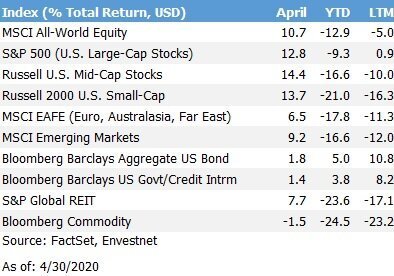

The market solidified the highest monthly returns seen in decades, leaving many investors confounded as they re-tool ingrained habits and experience an understandable fear of what may lie ahead. Most of the world is under some form of “lockdown” amid a pandemic unseen since the outbreak of Spanish Flu in 1918. All the while, in the face of the strongest headwind since the financial crisis, the S&P 500 rose 12.8% during the month.

There is little doubt we are in a recession though it cannot yet be declared[1] – GDP fell 4.8% in Q1 and a larger drop is expected in Q2. With our reality maps in uncharted territory, the market continues to digest the constant flow of “headline-worthy news”. The volatility, seemingly excessive, is not atypical considering the various moving parts that can drive a market day-to-day. Risk is measurable, but uncertainty is not, and using question marks for critical growth assumptions seriously degrade the value of any valuation model.

While we can’t make a silk purse from a sow’s ear, we can stay the course, a strategy that historically has bestowed risk-adjusted rewards. That said, one cannot blame investors for feeling displeasure as the search for sea legs continues.

AN OPTICAL DISCONNECT

The divergence between recent returns and economic data principally arises from the following:

The US government has committed to an unprecedented fiscal stimulus;

The Federal Reserve has intervened at levels not seen since since the financial crisis;

And, partially attributable to the above, the market is already peering beyond COVID-19.

No one knows how this will play out, but we do know that money flows where it is best treated. Historically, that is the equity market. We view bonds as ballast for the portfolio, helping one sleep better knowing those monies are readily available for living expenses should a prolonged downturn materialize. We do not believe this is likely, but if you want to find a fool, look for a prognosticator.

In the bond market, the Federal Reserve launched a junk bond purchasing initiative for the first time. It offers a clear signal to the market regarding the proactive steps it may take to counterbalance the contraction. Additionally, fiscal stimulus in the form of PPP via SBA and stimulus checks have buoyed investor sentiment despite dismal unemployment numbers.

In the face of such expansionary fiscal and monetary stimulus, one might think inflation expectations would tick upward, yet the market currently expects inflation of 1.05% over the coming decade[2].

PERSPECTIVE ON EQUITY VALUATION

A key input for any valuation model is the discount rate. And lower discount rates lead to higher equity valuations, all else equal.

Below are a few simplifying assumptions:

A1: the lower the interest rate, the lower the discount rate ought to be;

A2: 100 years of profits are created and returned to investors – here, a real $20/year;

A3: a company’s value is determined by the sum of its discounted cash flows;

When analysts discount[3] the expected futures earnings of a company to “discover” its worth today, the value is very sensitive to certain inputs. We’ve held growth constant at inflation for the sake of simplicity. Holding other inputs constant, let’s evaluate at how a 1% shift in the discount rate affects the price today.

Using a 5% discount rate regarding the real $20 cash flow to be received 100 years from today, it is worth a dozen pennies in 2020. Discounting all cash flows yields a value of $398 for the firm. However, if we discount the same $20 at 4%, then the value today is 35 cents, and the firm $491.56. That is, the stock is theoretically worth 24% more due to a 1% reduction in the discount rate, all else equal.

Year-to-date, 30-year US treasury yields have fallen from 2.39% to 1.28%. These bond yields are used as an essential building block in developing an appropriate discount rate and therefore also firm and index intrinsic values today.

WHAT IT ALL MEANS

An asset allocation that works for you allows you to stay the course through the ups and down without losing sleep. Financial planning plays a critical role. A diversified portfolio grounded in evidence-based financial theory is needed. We strive to ensure our portfolios are specifically crafted with your goals in mind, with a focus on capturing the return you are due for risk you are taking. One cannot avoid risk, regardless of how one invests or does not invest – it simply takes different forms.

One’s long-term asset allocation is shaped by one’s unique needs, goals, time horizon, and risk tolerance. We believe investors should hold as much equity exposure as possible but not so much as to risk being forced to liquidate stocks at an inopportune time. Over time, equities have provided most of the growth in any portfolio, in contrast to bonds which provide ballast[4] during downturns. One can lean on them during a recession or when life throws its inevitable curveballs. In short, the fact of the matter remains the same; that is, every investor needs a plan tailored to his or her specific needs.

2020 may be remembered as a period in which sticking to one’s plan, with a properly diversified portfolio, was as important as any since Black Monday, the Tech Bubble, or the Great Financial Crisis. Through each crisis, investors who stayed the course, in the face of market gyrations, realized their reward.

If you have any questions about your asset allocation, financial plan, or wish to discuss anything top of mind, we are here for you.

[1] A recession is broadly defined as two consecutive quarters with negative growth. Therefore, it is not possible for such a declaration at this juncture.

[2] Expected inflation is an imputed number based on current prices of 10-year treasury inflation-protected securities relative to nominal treasuries.

[3] For example, discounting $100 to be received one year from now at 5% results in a current value of $95. Discount rates reflect many variables, but one important benchmark input is the prevailing interest rate.

[4] This assumes one does not wish to pick up pennies in front of a steamroller – e.g., when “reaching for yield” sometimes one draws back a nub. Return of capital is more important than return on capital.

Contact us at 865-584-1850 or info@proffittgoodson.com

Please see disclosures