How the Sequence of Returns Can Impact You

At some point, usually in retirement, your investment portfolio may serve as an income source. When that time comes, it is important to consider a subtle risk that can have an impact on your wealth.

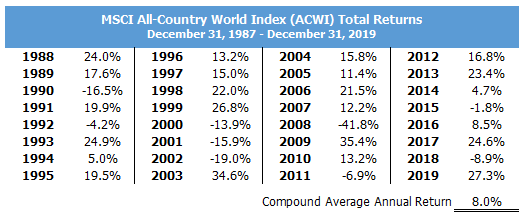

Let’s consider a hypothetical example of $1 million invested in a globally diversified stock index, the MSCI All-Country World Index (ACWI) beginning December 31, 1987, and ending December 31, 2019[1]. Over this 32-year period, the compound annual average total return was 8.0%. Let’s also assume that we withdraw $40,000 each year (adjusted for inflation) from the portfolio.

Here is how the 8% average return evolved:

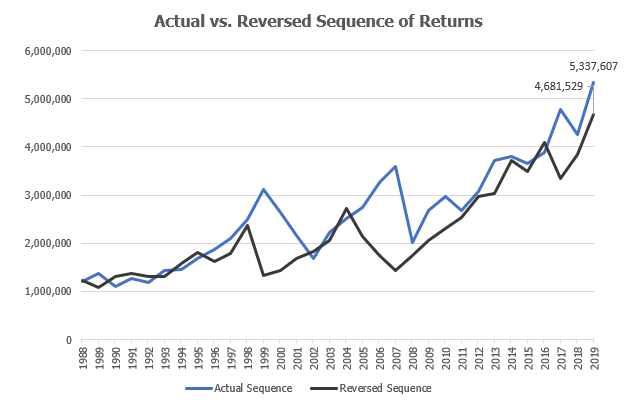

With the assumptions discussed above, at December 31, 2019, the ending portfolio value would have grown to $5.3 million.

Now, assume the order of the returns is reversed. The average return is the same at 8.0%. But this portfolio of $1 million would have turned into only $4.7 million – a difference of approximately $600,000 from the actual sequence.

Notice – in both cases, the investor took out $40,000 per year, the market had the same compound annual average total return, but the ending portfolio assets are different.

So why the difference? This is the subtle but important risk commonly referred to as sequence of return risk. The order in which market returns occur matters. Money taken out in periods of bad returns never gets a chance to recover in the subsequent periods of good returns. On the flipside, periods of good market returns allow for a little extra to spend.

Unfortunately, the order in which future market returns unfold is unknowable, but here are some strategies to reduce the impact of the sequence of returns:

Allocate a portion of your portfolio to less volatile and uncorrelated assets. These securities may hold their value when stocks are down, reducing dips in your portfolio. How much you need depends on your circumstances.

Anticipate future distributions or liabilities. The better we can anticipate, the better we can come up with a plan and be opportunistic. A good plan may mean creating a reserve for expected withdraws or adjusting the investment strategy to meet cash flow needs.

Be flexible in a distribution strategy. In periods of poor market returns, it may be prudent to lower your distribution rate to weather the storm. Alternatively, a series of good market returns may allow for higher distributions or call for more conservative distributions to save for bad times. In addition, it may be worth reevaluating certain planned cash flows. It may not be ideal to adjust living standards based on market performance, but some wants could be pushed off during tougher times, reducing the impact of withdrawals on your portfolio.

A well-crafted plan should manage sequence of return risk. Projecting portfolio values with average returns will not cut it. We incorporate a Monte-Carlo simulation into our portfolio and retirement income analysis to identify and find solutions to minimize sequence of return risk. We recommend revisiting your retirement income analysis every few years and when your life or market conditions change.

[1] This is a hypothetical example. No one can invest in an index. Indexes do not account for fees and transaction costs.

Contact us at 865-584-1850 or info@proffittgoodson.com

Please see disclosures