Inflation is 6.2% - Should You be Worried?

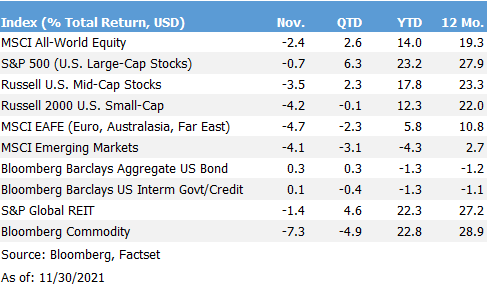

News of the spread of a highly contagious COVID variant kicked off a retreat in risky assets in November. Global stocks retreated from new highs set in October, falling 2.4% in November while oil prices collapsed over 20%.

Bonds benefitted from the knee-jerk pullback in market sentiment. After reaching 1.7% in October, the yield on the 10-Year Treasury fell to 1.4%. Inflation expectations, based on the yield spread between Treasuries and Treasury Inflation-Protected bonds, retreated to 2.5% from 2.75%.

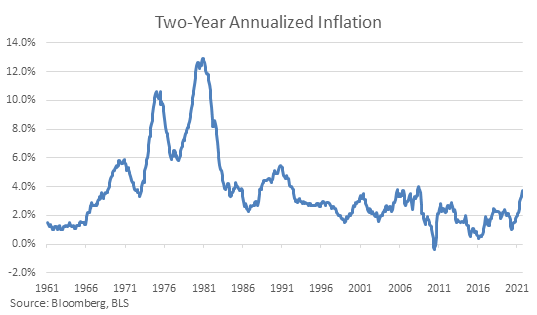

The bond market’s inflation expectations are lower than recent inflation reports. Consumer prices rose 6.2% in the last twelve months ending in October. That’s the highest reading in thirteen years. 6.2% is high – not 1970s high – but higher than it has been in some time.

While it’s conventional to measure price changes over twelve months, it can be misleading if prices dropped suddenly as they did last year. Energy prices, which are the most volatile component of inflation, collapsed during the initial stages of the pandemic, pulling inflation down at the time. Now, prices are being measured against those depressed levels. One way to adjust for this is to compare prices from two years ago. The annualized two-year price change suggests inflation is running at 3.7%.

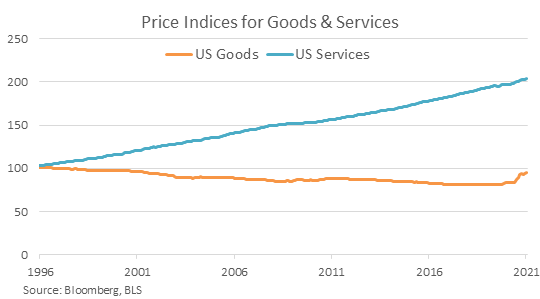

Still, 3.7% is higher than the average of the last decade. This is because the prices of goods suddenly jumped as we all bought Pelotons and bread makers and stopped dining out and going to the gym. In fact, right now we’re consuming so much stuff, the cost of shipping has risen, and the ports and supply chains are logjammed. Supply has been unable to keep up with the insatiable demand.

That blip at the end of the orange line in the chart above is the jump in the price of goods we currently demand but are in short supply. It’s a 17% jump in prices since 2019. Should we expect the price of goods to continue to rise? The price of the actual widgets and gizmos have been falling for decades as a result of globalization and technological innovation. Does the pandemic reverse decades of this? This seems unlikely.

There could be more to the inflation story than the relative rise in the price of goods compared to the price of services. The Federal Reserve has expanded its balance sheet through its zero-interest-rate policy and bond-buying programs. Through pandemic relief and infrastructure spending, fiscal spending has increased as well. All this spending and money creation have the potential to be inflationary.

But one lesson from the financial crises is that money creation does not necessarily lead to inflation. If the money sits idle on bank balance sheets, that’s not inflationary. If the money is used for productivity-enhancing investments that lead to new technologies and efficiency gains, that is also not inflationary. It’s not at all clear what the ultimate impact of government spending and monetary expansion will be. It gets complicated – welcome to the dark art of macroeconomics.

WHAT IT ALL MEANS

Right now, demand for goods is outpacing the supply as COVID has hamstrung the supply chain. That is the classic recipe for rising prices, but it’s too early to call this a chronic problem. People can only buy so many Pelotons and renovate their kitchens so frequently. Eventually, demand will moderate, and supply will catch up. How long that takes is anyone’s guess.

All of this is to say, right now, this bump in inflation will likely moderate. There are some early signs the ports are being unclogged. Inflation may settle in the 2-3% range for some time. That would be higher than the last decade but also perhaps a sign of a healthy economy operating at full capacity. Economic historians argue that the deficit spending of WWII was the boost needed to finally recover from the Great Depression. Similarly, the efforts to revive the economy from the pandemic may ultimately prove to be the relief from the Great Recession of more than a decade ago.

What matters is how well your life and investment portfolio can withstand unexpected bouts of inflation. Different types of assets respond to inflationary shocks in different ways. It’s important to consider this, along with your own circumstances, to find a long-term investment strategy that works for you.

Contact us at 865-584-1850 or info@proffittgoodson.com

Please see disclosures