Political Y2K?

On many accounts, tomorrow’s presidential election will be one for the history books. With the nation feeling exceptionally polarized and anxiety on both sides of the aisle elevated, you are not alone in worrying about what may come next and how it could impact your portfolio.

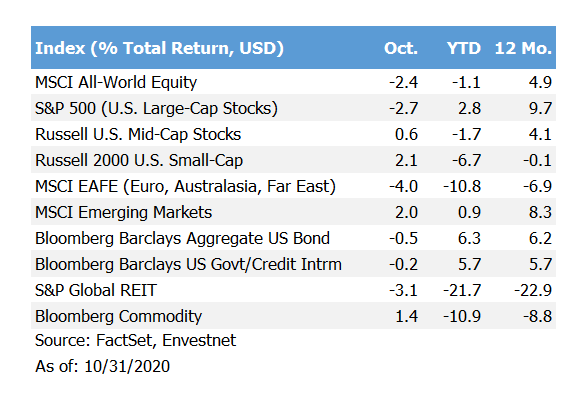

After a wild ride this year, the stock market retreated in September and October, with global stocks pulling back about 5%. Concerns that additional fiscal stimulus will be delayed and a resurgence in COVID-19 infections have added to election uncertainties.

As we recently wrote, historically election results matter very little for the financial markets. Past stock market returns are similar under either of the major US political parties. Still, today’s circumstances make this election feel different. There are some election scenarios that could unnerve investors, particularly the lack of a clear result. The markets despise uncertainty and a lengthy contested election could precipitate a significant increase in volatility until things are peacefully resolved. A clear election result should calm the markets.

Nonetheless, we firmly believe attempting to time the market, especially around political outcomes, is very difficult and often detracts from long-term performance. Deciding how the market will react to a change in government policy is challenging. To do so requires: 1) correctly determining who will win, 2) deciphering which campaign promises will be prioritized, and 3) guessing how those promises will ultimately pass through Congress and turn into actual legislation. Threading the needle on that political trifecta is a challenge even for the best forecasters.

Stocks can lose money over short periods, but longer-term investors have been rewarded for riding out near-term gyrations. When the world feels unusually uncertain, it’s best to stick to a plan built with your long-term goals in mind.

We continue to believe that a well-balanced approach can help mitigate some of the volatility. Diversification within and across asset classes helps. International stocks can alleviate the pains if any one country or continent struggles. Inflation-sensitive assets offer a reprieve if inflation unexpectedly increases. Lastly, despite low-interest rates, high-quality bonds can provide a liquidity buffer if stocks were to take a more drastic turn lower.

The world continues to feel exceptionally uncertain. Investing success doesn’t depend on forecasting the future but keeping a long-term focus and sticking with your plan. Having the courage, faith, and discipline that your plan and strategy will work for you, even when the world seems like a frightening place, is paramount. As the events unfold, we will continue to keep a close eye on your portfolio and financial well-being. As always, let us know if you would like to discuss your situation.

Contact us at 865-584-1850 or info@proffittgoodson.com

Please see disclosures